Inside BBVA 15+ Year Digital Transformation

At BBVA, digital transformation is a way of life. Here’s how it’s paying off.

Add bookmark

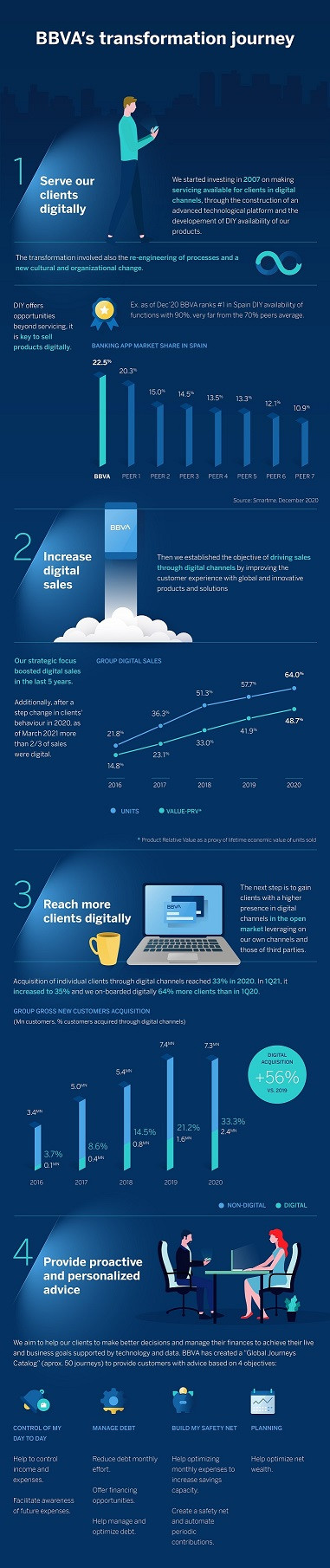

BBVA’s (Banco Bilbao Vizcaya Argentaria, S.A.) digital transformation began all the way back in 2007. The goal was to deepen its connection with its customers through the delivery of self-service, digital services.

Since then they have evolved from simply offering digital services to developing and selling new digital banking products. As a result, BBVA has grown into one of the largest banks in the world with over 80 million customers across 30 countries. In addition, BBVA has received a number of accolades for its digital banking strategy including being named 2021’s most innovative bank in Europe by The Banker Magazine.

As BBVA’s Global Head of Client Solutions, David Puente, explained in a recent corporate Q&A, “Digitization has clearly played an essential role in our organic client growth and will undoubtedly continue to do so, as reflected in our sales through digital channels, which already account for more than two thirds of the total.

Our objective is, on the one hand, to continue to grow both in our own channels and those of third parties, and on the other, in high-value verticals such as SMEs, private banking, companies with multi-country footprint, as well as in payment and insurance products where, thanks to our digital transformation, we are especially prepared to accelerate our growth opportunity.”

What separates BBVA from the numerous other companies out there undergoing digital transformations is that instead of focusing just on reducing costs they focused on revenue growth and customer retention. Here’s a look at how.

Using digital technology to improve the financial health of customers

In our Data Monetization Quick Guide, we explained how BBVA is using machine learning algorithms to mine customer data to provide personalized financial advice. This original tool was rather straightforward and worked by using ML to sort customer transactions into common budgeting categories (i.e. rent, food, and entertainment). This information was then shared with customers using a simple, easy to read visualization embedded in their personal finance app as a dashboard.

Over the past 5 years these tools have evolved significantly and now do everything from helping customers better manage daily expenses to providing debt management advice. In addition, according to the BBVA website, the interactions of the bank's customers with these tools have increased by 73%, from 11 million in November 2020 to 19 million in the same month this year.

Furthermore, the NPS (Net Promoter Score) for users of financial health tools is 38.6 compared to 29.2 for customers who do not use them. As more satisfied customers are often more loyal, BBVA found that the probability of losing customers who use the financial health functionalities is 1.28 points lower than non-users.

Banking as a Service (BaaS)

In many Mexican and South American cities, cash is king. In order to ensure its drivers were able to effectively and safely collect fares as well as be properly compensated for their work, BBVA partnered with Uber and Mastercard to launch a new digital debit card for its drivers.

This digital service enables Uber employees to receive their earnings within minutes and access both financial (e.g. credits) and non-financial benefits (e.g. discounts and rebates when refueling).

In the years since this partnership, BBVA’s Banking as a Service (BaaS) offerings have continued to evolve. In fact, just this past year, BBVA partnered with Google to provide Google Pay users with digital bank accounts.

Digital Transformation as a way of life

Rather than a distinct process with a beginning and an end, for BBVA digital transformation is an ongoing process. Case in point, BBVA just recently signed a 10-year agreement with Accenture “that is focused on accelerating digital transformation and applying analytics and artificial intelligence (AI) to drive faster decision-making and enhance the customer service experience.”

Together they will seek to “accelerate digital transformation across BBVA’s core operations, providing the entity with better insights and the ability to move faster and offer clients more effective services.”

In order to enable the efforts, BBVA will use Accenture’s AI-powered SynOps platform, a “Human-Machine Operating Engine” that leverages RPA, advanced analytics and intelligent automation to transform complex business processes.

BBVA understands that at the current rate of technological change, no one can afford to rest on their laurels. Instead of digital transformation organizations must integrate constant innovation into their daily operations if they want to survive the next decade.